华泰宏观解读美联储5月FOMC决议(加息或暂停,但能否不降息)

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 54-3/4 to 5-1/4 percent. The Committee will closely monitor incoming information and assess the implications for monetary policy. In determining the extent to whichThe Committee anticipates that some additional policy firming may be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time. In determining the extent of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in its previously announced plans. The Committee is strongly committed to returning inflation to its 2 percent objective.

The U.S. banking system is sound and resilient. Tighter Recent developments are likely to result in tighter credit conditions for households and businesses are likelyandto weigh on economic activity, hiring, and inflation. The extent of these effects remains isuncertain. The Committee remains highly attentive to inflation risks.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michael S. Barr; Michelle W. Bowman; Lisa D. Cook; Austan D. Goolsbee; Patrick Harker; Philip N. Jefferson; Neel Kashkari; Lorie K. Logan; and Christopher J. Waller.

加息路径层面,鲍威尔表示,美联储接近或达到本轮加息终点,但对通胀前景的展望不支持降息。美联储的决议中删除了“预期进一步收紧政策可能是合适之举”的表述,取而代之的是“确定下一步合适的紧缩幅度时会考虑多种因素”。鲍威尔强调这一改变是重要的(meaningful),但也强调未来仍然会逐次会议(meeting by meeting)决定利率。对于是否停止加息,鲍威尔称,累计500个基点的加息使得政策利率已经到达或者接近到达足够有限制性的水平(sufficiently restrictive);同时,威尔也并未排除再次加息的可能性,称如果有必要将再次加息。针对市场当前的降息预期,鲍威尔仍然强调,FOMC通胀前景并不支持降息。

附录:美联储 3月FOMC声明相较 2月的变化

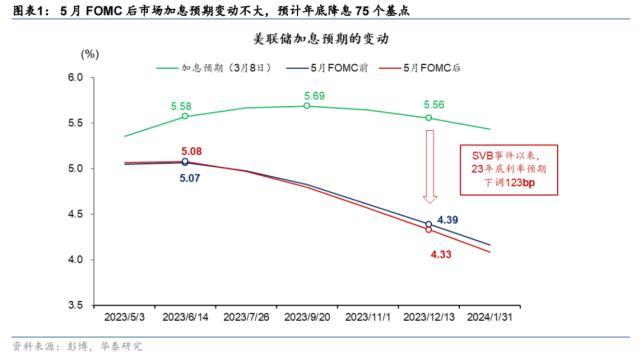

北京时间5月4日(周四)凌晨,联储5月FOMC决议加息25个基点、基准利率升至5.0%-5.25%区间,决议声明中删除了“预期进一步收紧政策可能是合适之举”的表述,暗示未来可能停止加息,但鲍威尔仍然强调通胀水平不支持下半年降息,让预期年内降息三次的市场较为“失望”。缩表方面,美联储仍然维持月度950亿美元(600亿国债 350亿MBS)的缩表速度。截至北京时间凌晨四点,相对会前,市场交易“衰退概率”上升——标普500及纳斯达克综指分别下跌0.7%和0.5%,2年和10年期美债收益率下降11bp和7bp,美元指数走弱。会前市场预计5月加息22bp, 但2023年下半年从高点降息68bp, 而5月加息25bp落地后,下半年预期累计降息幅度上升至75bp(图表1)。

核心观点

。美联储已快速加息500个基点,增长动能持续放缓,就业市场降温,通胀有所降温,但仍位于较高水平(图表2-4),美联储或有必要停止加息以评估此前加息以及银行风波的影响。同时,近期美国第一共和银行被接管(参见《美国第14大银行倒闭昭示了什么?》,2023/5/4)以及债务上限触发时点提前(参见《美国债务上限提前触发会有何影响?》,2023/5/4)均收紧金融条件,可能导致市场波动加大,为实体经济降温。联储3月SEP与市场隐含的利率路径存在较大背离(图表5),背后隐含的是美联储对经济软着陆(经济放缓或温和衰退,但失业率不明显上升)和金融体系软着陆(维持高利率,但金融系统保持稳健)的乐观预期,我们认为,上述“完美情形”可能难以如愿。高利率环境下经济和金融体系的演变或是非线性的,3月8日以来的硅谷银行风波就是佐证。不排除实体经济和金融体系的压力在今年下半年加速演绎,促成联储被动转向。风险提示:美国债务上限僵局持续时间超预期、联储政策收紧超预期。

Economic activity expanded at aRecent indicators point to modest pace growthin the first quarterspending and production. Job gains have been robustpicked up in recent months, andare running at a robust pace; the unemployment rate has remained low. Inflation remains elevated.

基本面方面,联储表示美国避免经济衰退的概率仍然较高,就业市场有所降温,但通胀回落较慢。银行业整体情况在改善(broadly imporved),但是银行风波加剧信贷条件紧缩,对增长拖累的幅度仍然难以判断,未来需要关注银行信贷条件收紧的影响。虽然美联储工作人员预计年末将出现温和衰退,但鲍威尔认为,2023年美国经济将适度增长,避免经济衰退的概率高于经济衰退的概率;未来可能延续就业市场降温,但失业率不上升的状态。鲍威尔指出,劳动力市场更加趋向均衡(better balance),劳动参与率回升,岗位空缺下降,但劳动力市场仍然存在大量过剩需求;工资增速有所回落,但通胀回到2%要求工资增速需要回落至3%左右。对于通胀前景,鲍威尔称,通胀不会很快回落,住房外的其他服务通胀过去一段时间并没有明显改善。

本文源自券商研报精选

本文摘自2023年5月4 日发布的《 FOMC: 加息或暂停 , 但能否不降息?》

文章来源

一路暴涨的上海房租戛然而止!往年客多房少,如今租客都能还价!

近日,有报道称,受疫情影响,上海的租房市场出现下滑,特别是对外地人的吸引力减弱,导致房租价格下降。这一现象引发了人们对外地人在上海租房市场中所扮演角色的关注。长期以来,上海一直是国内最具吸引力的城市之一,吸引了大量的外地人前来工作、学习和生活。这些外地人在租房市场上扮演了重要的角色,他们的需求推动了房租价格的上涨,也使得上海的租房市场一直处于供不应求的状态。大财经2023-12-01 13:38:020000面对众多车主质疑,中石化和中石油强势回击:数据揭示实力优势!

当今社会,石油是世界经济的命脉之一。然而,由于石油勘探与开发所产生的环境问题以及能源消耗引发的气候变化等,对于石油公司的质疑声也愈发高涨。中石化和中石油作为中国两大石油巨头,备受质疑的目光投射过来。然而,面对众多质疑,他们向世界宣示——实力优势!大财经2024-01-09 15:44:410000资源机是什么意思 资源机靠谱吗

因为近期有出游的计划,家住北京市丰台区的张铮研究起了一项自己此前从未了解过的“技术”——“电媒捕鸟”法。所谓“电媒捕鸟”,指利用电媒机播放不同鸟类的叫声来吸引其同伴,并通过设置陷阱来猎捕的一种方式。记者调查后发现,当前在电商平台有不少店铺在售卖诱捕野生鸟类的“黑科技”,既有专门的“媒音卡”,也有电媒机这种一体机,用来“辅助”购买者捕鸟。0000企业发展战略 企业运营十大核心

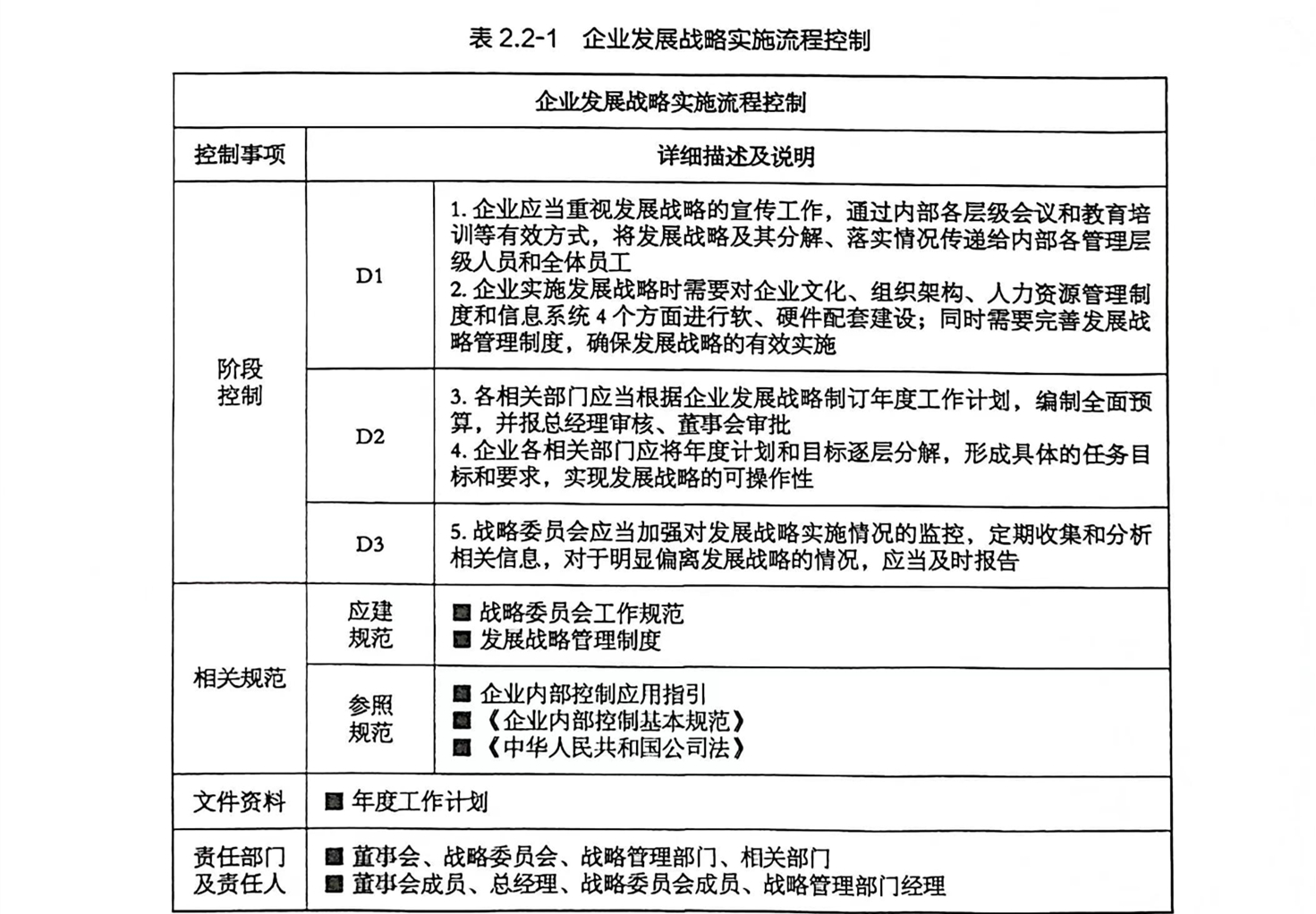

发展战略的有效性必将落脚于发展战略的实施。只有在实施中,发展战略才能发挥作用;也只有在实施中,企业才能及时调整发展战略。而要切实有效地实施发展战略,则需要依赖于详细、完善的战略实施计划。2.2.1发展战略实施流程大财经2023-03-24 22:15:480000